This is my first winter back on the East Coast with icy streets and a snowstorm in New York (ugh), after spending the past few “winters” in California. Since moving to NYC, Urbana Gallery & Cafe in Chelsea has been my go-to writing spot on cold days. I’m watching people shuffle past in scarves through the window as I type this. Hope you’re staying warm this February!

This post is part 3 of an essay series on this idea: an exploration loop between capital, science, and an integrated stack (energy, data, and distribution) creates compounding advantage. I first framed it in December while rereading Sapiens, then looked at how it shows up in Shenzhen in January. Today, I want to ground it in something very tangible: the action camera market.

It’s a fun category driven by the creator economy on YouTube/TikTok, and also a clear example of how advantage gets built, defended, or lost. Two questions I’m most intrigued by:

How does this exploration cycle show up in action cameras?

How sustainable are these models in 5 years?

Photo by Red Zeppelin on Unsplash

Action camera market in 2026

Action cameras essentially sell this: capture something intense, then share it fast. The first part is a competition for hardware (e.g., portable form factors), while the second part is about software (e.g., AI tools that reduce effort from footage to story).

So in this market, the exploration cycle comes from being able to move quickly and control key inputs to keep moving quickly: components, manufacturing, distribution. The best players don’t just ship cameras, they ship the easiest path from moments to shareable content.

By late 2025, state of the market (estimates vary by tracker):

DJI leads with 66% of global market, built on an integrated stack and industrial scale.

Insta360 is the fast climber (13-31%, surge in Asia-Pacific), built on speed, creativity, and workflow.

GoPro still has the name (18%), but hardware momentum falls; it leans on brand, subscriptions, and lawsuits.

Three kinds of compounding advantages

They represent three different kinds of loops, each bringing unique advantages:

DJI: the science, scale, and ecosystem

DJI is often called the “Apple of drones” and it has the strongest compounding loop among the three: deep R&D, supply chain, industrial scale, and ecosystem that spans consumer and enterprise (think agriculture and inspections).

They not only iterate quickly, but also build many of the “hardware legos” (sensor tech, stabilization hardware, transmission protocols, etc.) that can be reused across categories and set the market’s baseline. That’s what makes DJI hard to catch: their advantage isn’t one product, it’s compounding capability.

Insta360: speed, taste, and friction removal

Insta360 is the most interesting growth story in this category (with explosive YoY growth +76.8%). It’s a classic “hardware lego” player: start with strong off-the-shelf components (often from the smartphone supply chain), then differentiate through speed and product taste.

Their advantage comes from three places. First, iteration speed—shorter cycles, more frequent experiments, quicker response to what creators actually do. Second, creative form factors—sometimes “weird” designs that end up defining the category and lead the trend. Third, workflow—integrating AI and software that make editing feel lighter, so the camera doesn’t just capture moments, but is easy to publish.

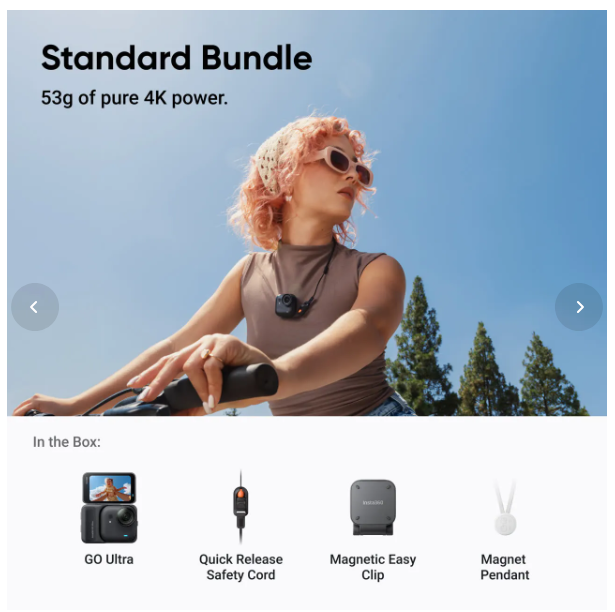

Insta360 GO Ultra (wear the camera as a pendant)

Camera can be detached for flexibility

GoPro: defend the brand

GoPro’s hardware loop is slower today, but it still defends its position, especially in North America, through brand, subscription, and litigation. The subscription piece is underrated. When a user charges their GoPro and footage auto-uploads to the cloud, switching becomes annoying. By late 2025, GoPro hit a record 70% subscriber retention, and service revenue reached $27M in Q1 2025, quietly turning the company into a cloud service business with hardware attached. Litigation plays a different role: it doesn’t improve the product, but it can slow competitors and buy time.

How sustainable are these models in 5 years?

My take for the next five years: DJI stays the global #1 because it compounds across an integrated stack and industrial scale. Insta360 becomes the durable #2 by owning creator workflow and setting consumer trends, especially in Asia-Pacific. It keeps DJI from becoming a monopoly and it pushes faster cycles, more creative designs, and better prices. GoPro continues to shrink into a brand-plus-subscription business unless it meaningfully shortens its product cycles. The biggest wildcard is geopolitics: U.S. policy can slow DJI’s pace more than any competitor can.

The action camera category won’t be a single-winner market. DJI and Insta360 will both win, for different reasons.

DJI wins when connectivity, reliability, and complex use cases matter. Its ecosystem (drones, gimbals, delivery bots, microphones, enterprise products for agriculture and inspections) lets it reuse capabilities and supply chain advantages across categories. It will likely generate the most profit in the market, concentrating in enterprise and pro-consumers, especially in areas that look more like infrastructure than consumer gadgets with less tariff scrutiny.

Insta360 wins where speed, flexibility, and cultural pull matter. Its strengths in AI-empowered workflows (editing, 360-reframing, ready-to-post outputs) plus playful form factors and modularity position it to set consumer trends. It can expand beyond “action” into broader creator contexts and workplace (meetings, conferences, events), where the same workflow problems exist.

Photo by Lorin Both on Unsplash

Where AI shifts the game: “don’t edit—ask”

The next AI interface shift isn’t just auto-edit, but also retrieving. People won’t want to scrub footage. They’ll want to ask: “Find the clip where I wiped out in the snow.” That favors companies that can build capture-to-understanding capabilities: image signal processing, metadata, and on-device intelligence.

By late 2025, both DJI and Insta360 are moving toward proprietary processing to enable the camera’s ability to “understand” what it’s seeing in real-time without getting constrained by heat and power.

Geopolitics as a speed brake

Tariffs and U.S.–China tensions add friction and can slow iteration, especially for DJI. The late-2025 move to effectively block FCC authorizations for new DJI drone models pushes DJI to pivot harder into enterprise (agriculture and delivery) and less-scrutinized non-drone products (Osmo Action, Pocket). Even when the underlying capabilities are strong, regulation can function like a brake on speed.

Photo by Leio McLaren on Unsplash

Ending note and open questions

This wraps the three-part series on the exploration loop and how it shows up at different altitudes (Sapiens → Shenzhen → action camera → DJI, Insta360, GoPro).

A few loose thoughts that aren’t part of the main thread:

Copying and IP. When DJI ships a new product, Shenzhen companies will copy the design and sometimes even lift DJI’s marketing footage in their own ads. Shenzhen doesn’t seem eager to tighten copyright enforcement, possibly hoping to expand the industry pie. The U.S. protects creators more aggressively. But does stronger enforcement also shrink the pie by limiting remixing and iteration? Where’s the real tradeoff between speed, fairness, and total output?

How DJI drives consumer adoption. DJI makes drones feel less intimidating, almost toy-like, which helped popularize consumer drones for aerial photography. Lower price points and ease of use also helped land it with more consumers.

The missing player in the Shenzhen story: ODMs. One add-on from part 2: I didn’t include ODMs (original design manufacturers). They handle R&D and product design, allowing small teams to ship without building a full hardware org. They are a big reason Shenzhen can move fast and accelerate prototyping, often alongside crowdfunding.

Thanks to Nemo for pointing out the ODM gap—super helpful. And thanks to Matthew for sharing interviews on DJI (from Sangrae and Jaewhan), which inspired me to look more closely at DJI’s design story while writing this post.

Let’s chat if you have thoughts, see anything missing, or are curious about similar questions here. See you in the next post!